How to Build your Credit Score with a Credit Card

Looking to build your credit rating? Whether you have no credit history or a poor credit score, our guide to using a credit card could give the boost you need.

Credit cards are a flexible way of borrowing money. They’re also super-easy to use, which is partly what makes a credit card such a good way to build your credit score.

In fact, simply owning a credit card account can be enough to start improving your credit rating. But if you really want to get the most advantage, it all comes down to how you use it.

To use a credit card to improve your credit score, you just need to use it as you would a debit card. That means treating the credit like it’s your own money and spending only what you can afford.

Just remember, we can never guarantee your credit score will improve. A lot of information adds up to make your credit rating (check out our guide on credit scores here), but following the steps below can go a long way to helping.

How to use a credit card – a quick background

When paying with a credit card, the credit card provider is essentially making the purchase for you. You’ll then need to repay the balance, either over a number of instalments or in one go, and usually charged with an interest rate.

That makes credit cards useful for a number of things. If you need to pay for a big one-off cost such as a car repair that you wouldn’t otherwise be able to afford, you can make the payment and split the cost over several months.

But watch out . . .

Credit cards also come with dangers. Because they’re so easy to use, that can cause trouble if you’re not so good at managing your money – so make sure you’re not spending beyond your means. It’s also important to keep an eye on the interest and clear the balance off before it can sting you.

Fortunately, to use a credit card to improve your credit score, you just need to use it as you would a debit card. That means treating the credit like it’s your own money and spending only what you can afford.

How to build your credit score with a credit card

Using a credit card to improve your credit rating comes down to three simple steps.

1. Use your credit card consistently

To boost your credit score, ideally you need to use your credit card a few times a month.

That doesn’t mean buying anything you wouldn’t usually buy. Just use the credit card for your normal shopping, such as groceries or when you’re paying for petrol.

While you could even use a credit card for all your monthly shopping, that leads us to point number two . . .

2. Avoid going over 30% of your available balance

If your credit card has an available balance of £1,000, you should try not to let the balance go over £300. Otherwise, the credit reference agencies could think you’re living close to your financial limit, which they could hold against you.

The best target is to aim for between 1%-10% of your balance. This shows you can borrow money and pay it back safely without being reliant on borrowing to get by.

3. Clear the balance in full every month

If you can, you should pay off the full balance on your credit card once a month. This may not be possible if you’ve used your credit card for any large one-off payments, but is important if you’re using your credit card for everyday spending.

This will demonstrate to the credit reference agencies that you can make your repayments on time, and should avoid you getting hit by any severe interest rates.

Most credit card providers will let you pay your balance by a Direct Debit with an option to clear the balance in full, making this simple to set up.

One more thing to remember

Whatever you do, make sure you’re always making at least the minimum payment on your credit card on time.

While it can be best to clear the balance in full, the minimum payment will still be enough to be reported positively to the credit reference agencies. However, making late payments or missing payments entirely is likely to have a very negative impact on your credit score.

In conclusion

Credit cards can be one of the quickest and simplest ways to build your credit score.

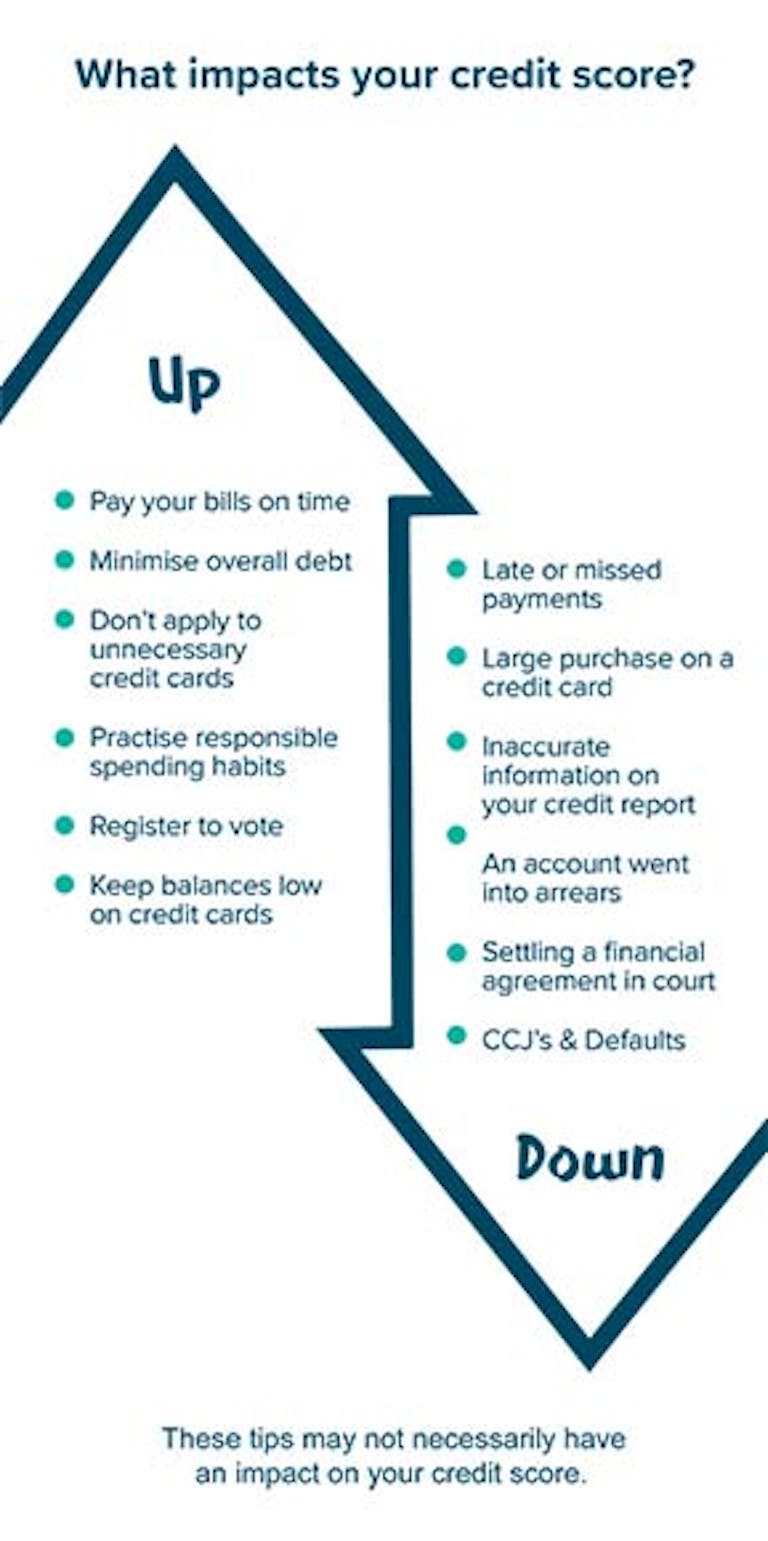

That being said, there are a number of factors that can affect your credit rating. We have a full guide on boosting your credit rating over here, but otherwise you can check out our handy diagram below.